If you’re going to go into real estate investments, there are a few equations that you should know. While you don’t need to be a mathematician, these are super important, since they do affect the overall impact of your success in real estate investment. This article will go over a few that you should master.

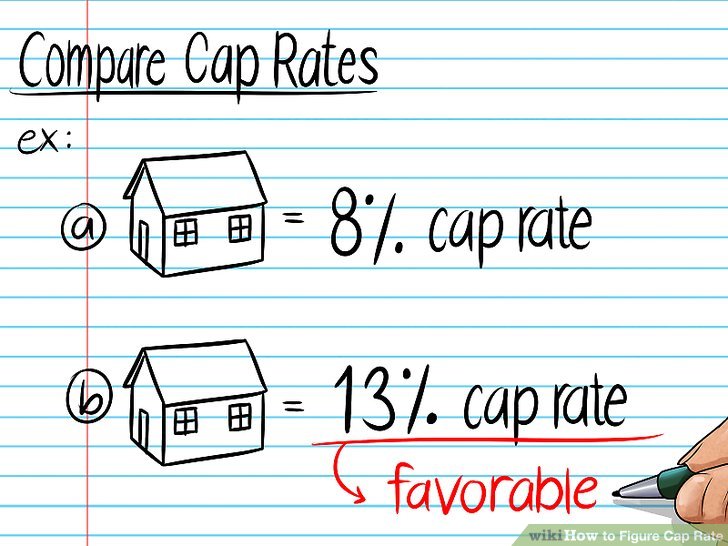

The first, is the cap rate. This is the total income divided by the cost of the property. This is used for valuing the apartment complexes and commercial buildings. It’s used for multifamily homes too, but often if you use it for the latter, it can mess with the operating expenses, since you don’t know how often the turnovers will happen. With the cap rate, you want it to be an 8 or better, since it should be better than most of the buildings in the areas. You should use real numbers or estimates to calculate this, and don’t just take what’s on the form.

Rent divided by property cost is another huge one, since this is a good calculation that you can use for houses, and some multifamily apartments and homes. However, it should also be used when you’re comparing the rental value of properties. The one thing that you should make sure that you do is not compare the rent cost of a property between two totally different things. If you’re looking at a dangerous war zone area, in comparison to a gated community, it’s not worth it. The roof will cost the same and square foot is the same as well. Obviously, the vacancy and the delinquency will be higher in an area that’s bad. So, remember this doesn’t tell you the cash flow, but instead you should make sure that you’re looking at similar properties in the area. You should try to be around 1% to about 1.5% ideally.

The gross yield is another. This is the annual rent divided by the total price of the actual place. This is the same calculation flipped around that can be used when you value larger portfolios. It’s the same thing as the rent/cost, but just literally flipped around.

The debt/service ratio is a super critical one to look at. In essence, it’s the net operating income divided by the annual debt service. This is one that banks will look at when you’re trying to get financing. Typically, a bank will look at this in terms of the property’s debt service ratio, and also the global debt service ratio, which is a fancy term for your portfolio period. With this one, you always want to be over 1. You know why? Because anything less means that you’re losing money.

Cash on cash, which is the cash flow/cash into deal that you need to look at, is probably the most important number for any real estate investor to have. This will tell you straight up what kind of return that you’re getting from this. for example, let’s say you’re taking in a 40K deal and you made 10K on that from the year, you’re making about 25%. In the same vein, if you take a 100K deal and make 10K, it’s a 10% respectively.

Now, this is critical because it not only tells you what the value of a property is, but it will also evaluate what kind of debt and equity structure the thing has before you begin to purchase it, so it helps you get everything ready before you begin.

Finally, there is the 50% rule, which is something that tells the estimate of the property. It’s simply dividing the cost of it by two, and that’s how much you’ll need to put in. a good rule of thumb is that a nicer building will have a lower ratio of this, and a shoddier building a higher one. This will help if you’re not sure if you want to take on the operating costs of something.

These calculations are super important, and as a real estate investor, you need to know every single one of these in order to truly get the success that you so desire from each investment. Best part is they’re simple too.